- Home

- Views On News

- Feb 11, 2024 - Paytm Shares Tread Troubled Waters: These Mutual Funds May Feel the Impact

Paytm Shares Tread Troubled Waters: These Mutual Funds May Feel the Impact

India's leading Fintech company, Paytm (a subsidiary of One97 Communications Ltd.), that offers digital payments and financial solutions to consumers, has been embroiled in a regulatory hurdle.

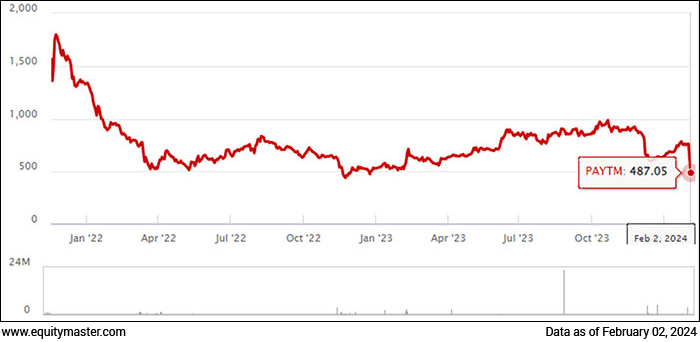

Consequently, its stock price has crashed more than 40% in the last couple of days, and has hit a lower circuit. The stock has plummeted around 75% from its all-time high level achieved in November 2021, a few days after it was listed on the exchanges.

The sharp fall in the share price has impacted the NAVs of mutual fund schemes holding the stock.

Why are Paytm share prices falling?

On January 31, 2024, the Reserve Bank of India (RBI) barred Paytm Payments Bank from accepting fresh deposits and making credit transactions after February 29, 2024. As per the directive, the payments bank account cannot accept deposits, credit transactions, and/or top ups in customer accounts, prepaid instruments, wallets, FASTags, and National Common Mobility Cards from March 2024.

This comes in the aftermath of the March 2022 action in which the RBI had prohibited Paytm Bank from onboarding new customers and mandated a comprehensive external audit of Paytm. The compliance validation report prepared by these external auditors uncovered that Paytm Payments Bank exhibited what the RBI termed as persistent non-compliance and ongoing significant supervisory concerns.

One97 Communications Ltd, the parent company of Paytm expects a 'worst case impact' of Rs 3 bn to Rs 5 bn on its annual EBITDA going forward due to the impact of RBI's latest directives on Paytm Payments Bank.

One97 Communications owns and operates the brand Paytm and holds a 49% stake in Paytm Payments Bank, with the remaining 51% owned by Vijay Shekhar Sharma, the founder and CEO of Paytm, according to the company's 2022-23 annual report.

Paytm Payments Bank is accessible solely through the Paytm app, and funds from the bank are exclusively available through the app, with registration and login facilitated only via the app. Moreover, the Paytm app serves as the primary platform for promoting and distributing all bank services.

Furthermore, all of Paytm's 330 million-plus wallet accounts and 150 million-plus UPI handles are housed within Paytm Payments Bank. To address this, the RBI has instructed One97 Communications Ltd. and Paytm Payments Service Ltd. to terminate their nodal accounts with the bank immediately. Note that nodal accounts are specialised accounts designed for receiving payments from various bank accounts and transferring them to merchants.

Paytm share price performance since listing

On the brighter side, despite the hit Paytm expects that it will continue on its trajectory to improve its profitability. Paytm also said that it will work with other banks and not with Paytm Payments Bank and that the next phase of its journey is to continue to expand its payments and financial services business, only in partnerships with other banks.

The company has also clarified that its founder, Vijay Shekhar Sharma, has not taken any margin loans or pledged any shares directly or indirectly owned by him.

It is noteworthy that Paytm share price have been under pressure since its listing in November 2021 due to a series of events such as the RBI prohibiting new client onboarding, low ratings by brokerage firms, rising interest rate environment, and its high valuation.

Do your Mutual Funds have exposure to Paytm stocks?

Most mutual fund schemes have avoided holding high exposure to Paytm stocks. As a result, the impact on the NAVs of the schemes will not be substantial

As of December 31, 2023, a total of 39 actively managed equity schemes held shares worth Rs 1,930 crore in Paytm. Among diversified equity mutual funds, Quant Mid Cap Fund held the highest exposure at 3.2% of its assets. Interestingly, various schemes of the Quant Mutual Fund were caught in a storm in the past due to higher exposure to troubled companies such as Adani group of companies. A few other diversified equity schemes such as Mirae Asset Focused Fund, the newly launched Helios Flexi Cap Fund, Motilal Oswal Focused Fund, and JM Value also held notable allocation to Paytm shares.

Mutual Fund schemes having exposure to Paytm shares

| Scheme Name | Category | No. of shares | Market Value (Rs Cr.) |

% of assets | Holding since |

|---|---|---|---|---|---|

| UTI Innovation Fund | Sector/Thematic Fund | 4,15,350 | 26 | 4.8 | Oct-23 |

| Quant Teck Fund | Sector/Thematic Fund | 1,20,000 | 8 | 3.26 | Oct-23 |

| Quant Mid Cap Fund | Mid Cap Fund | 21,05,397 | 134 | 3.17 | Nov-23 |

| Nippon India Innovation Fund | Sector/Thematic Fund | 5,46,130 | 35 | 2.96 | Aug-23 |

| Mirae Asset Focused Fund | Focused Fund | 42,35,151 | 269 | 2.9 | Nov-21 |

| Helios Flexi Cap Fund | Flexi Cap Fund | 2,44,170 | 16 | 1.95 | Nov-23 |

| Motilal Oswal Focused Fund | Focused Fund | 4,41,804 | 28 | 1.57 | Apr-23 |

| JM Value Fund | Value Fund | 98,800 | 6 | 1.55 | Dec-22 |

| Franklin India Technology Fund | Sector/Thematic Fund | 2,30,649 | 15 | 1.23 | Nov-22 |

| Mahindra Manulife Flexi Cap Fund | Flexi Cap Fund | 2,25,000 | 14 | 1.23 | Jun-23 |

| Mahindra Manulife ELSS Tax Saver Fund | ELSS | 1,45,800 | 9 | 1.22 | Oct-23 |

| Mirae Asset Large Cap Fund | Large Cap Fund | 67,72,501 | 430 | 1.13 | Nov-21 |

Data as of December 31, 2023

(Source: ACE MF, data collated by PersonalFN)

Technology-oriented Sector/Thematic Funds such as UTI Innovation Fund, Quant Teck Fund, Nippon India Innovation Fund, and Franklin India Technology Fund were among the other schemes holding relatively higher exposure to Paytm shares.

Most of these schemes bought the stocks in 2023, when the stock started witnessing a turnaround amid a significant correction in valuations from the peak and improving earnings trajectory. It recently reported Q3 numbers where its revenue rose 38% y-o-y to Rs 2,850 crore and net loss narrowed to Rs 221.7 crore from Rs 392 crore a year ago.

Meanwhile, Mirae Asset Focused Fund and Mirae Asset Large Cap Fund have been holding the stock since its IPO launch in November 2021.

Out of around 44 mutual fund houses in India, 23 had exposure to Paytm stocks in their active and passive schemes. At the AMC level, prominent fund houses such as Mirae Asset Mutual Fund, Quant Mutual Fund, and Mahindra Manulife Mutual Fund held relatively higher exposure to Paytm stocks.

Mutual Fund houses having higher exposure to Paytm shares

| AMC Name | Holding (%) | Market Value (Rs Cr.) |

|---|---|---|

| Helios MF | 1.83 | 16 |

| Mirae MF | 0.64 | 1,011 |

| Mahindra Manulife MF | 0.53 | 91 |

| Zerodha MF | 0.32 | 1 |

| Quant MF | 0.3 | 141 |

(Source: ACE MF, data collated by PersonalFN)

What should investors do?

Despite scepticism towards high growth but non-profitable new-age stocks, various mutual fund schemes continue to hold them. Many of these, including Paytm, have turned out to be wealth destroyers in recent years, with no respite in sight.

This raises concerns about whether the schemes follow prudent practices to pick quality stocks, or are they simply follow momentum bets.

While Paytm founder Vijay Shekhar Sharma remains optimistic, referring to the RBI's move as a 'speed bump' and expressing confidence in overcoming challenges through partnerships with other banks, it is vital to remember its woeful past.

The shares of Paytm may continue to tumble and face pressure till its compliance-related concerns are dealt with and its fundamentals show persistent improvement. Therefore, mutual fund schemes holding higher allocation to Paytm stocks may witness some impact on their NAV in their near term.

However, since the fund managers have the flexibility to trim/redeem the allocation to Paytm stocks if the outlook remains unfavourable. Moreover, their practice of holding a range of stocks across different sectors in the scheme's portfolio may help mitigate the risk.

As an investor, it is always advisable to invest only in schemes that focus on picking quality stocks and avoid chasing momentum bets. Furthermore, prefer fund houses that follows prudent investment practices with adequate risk management mechanisms.

Additionally, investors should avoid investing in Sectoral/Thematic funds because if such incidents occur, the scheme could witness a sharp decline in its NAV due to the concentrated nature of the portfolio.

Moreover, it is important that investors hold about 5-7 quality schemes in the portfolio, depending on the size of the investment portfolio and financial objectives to enable optimal diversification across investment styles/strategies.

Safe Stocks to Ride India's Lithium Megatrend

Lithium is the new oil. It is the key component of electric batteries.

There is a huge demand for electric batteries coming from the EV industry, large data centres, telecom companies, railways, power grid companies, and many other places.

So, in the coming years and decades, we could possibly see a sharp rally in the stocks of electric battery making companies.

If you're an investor, then you simply cannot ignore this opportunity.

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Equitymaster requests your view! Post a comment on "Paytm Shares Tread Troubled Waters: These Mutual Funds May Feel the Impact". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!